Nickel has become one of the most influential commodities in today’s global economy. From powering electric vehicle (EV) batteries to strengthening stainless steel, its role spans key industrial sectors. As industries expand and clean-energy initiatives accelerate, the demand for nickel continues to climb—putting more pressure on investors and companies to stay ahead of market movements. This is where FintechZoom.com Nickel becomes useful, offering accessible insights on trends, pricing, and global developments.

This article explores how FintechZoom.com covers the nickel market, how accurate its data is, and whether investors can rely on it for real-time updates. You’ll also find comparisons against major competitors, expert-level takeaways, and practical tips for tracking Nickel using FintechZoom.

The Role of Nickel in the Global Economy

Nickel plays a critical role in modern industry, and its importance continues to grow as global manufacturing expands.

1. Stainless Steel Production

Roughly 70% of all nickel produced worldwide is used to manufacture stainless steel. Its contribution to corrosion resistance and durability makes it indispensable for construction, infrastructure, and manufacturing. Because stainless steel demand rises yearly, nickel consumption naturally follows.

2. Battery Technology & Electric Vehicles

Nickel-rich cathodes are essential for EV batteries as they increase energy density and storage capacity. As automakers shift toward cleaner technologies, the demand for nickel-based batteries continues to surge—transforming nickel into a strategic metal in the transition to renewable energy.

3. Growth in Producer Economies

Countries like Indonesia have seen rapid economic development due to nickel mining and processing. With output nearly doubling in recent years, Indonesia has become the world’s largest producer and a major influencer in global supply chains.

4. Price Volatility & Geopolitics

Trade restrictions, export bans, and shifting alliances directly affect nickel pricing. Indonesia’s export policy changes, for example, caused major disruptions and reshaped supply chains across Asia and Europe.

5. Environmental & Social Impact

Nickel mining has raised concerns related to deforestation, pollution, and ecological damage. These environmental costs have pushed governments and companies to examine sustainable mining practices more closely.

6. Clean Energy Strategy

As decarbonization accelerates, nickel has emerged as a fundamental resource—especially in the EV and energy storage markets. Its strategic significance continues to influence global trade policy and energy planning.

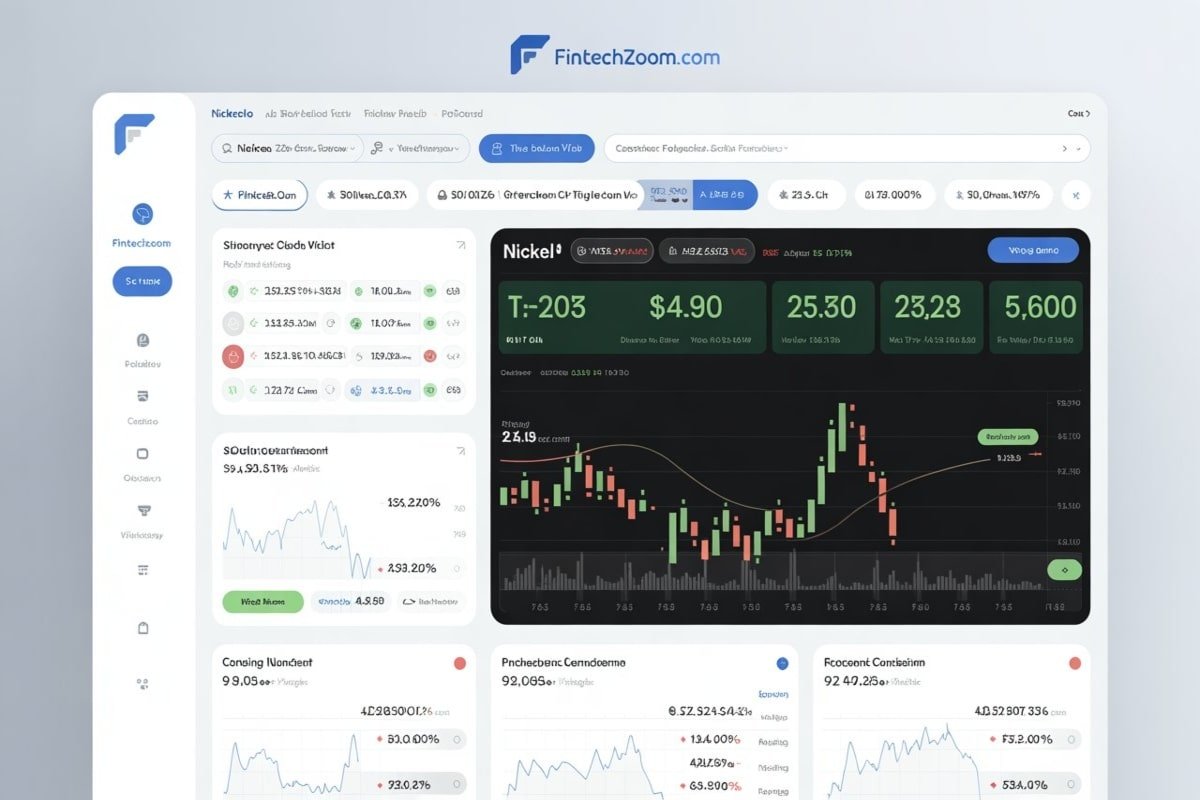

What Is FintechZoom.com?

FintechZoom.com is a digital platform offering:

- Market news and financial updates

- Real-time price tracking for stocks, crypto, and commodities

- Global economic insights

- Fintech trends and innovations

- Investment guides and market commentary

The platform is known for its simple layout, fast updates, and beginner-friendly approach—making it ideal for casual readers, traders, and investors looking to stay informed without needing advanced tools.

The Current State of the Nickel Market

As of 2025, nickel prices reflect a mix of economic recovery, industrial demand, and supply concerns.

Recent data shows nickel trading at around $15,732 per metric ton, slightly up from the previous day and higher than last month’s closing price. However, year-over-year comparisons show a decline from 2024 levels, suggesting broader market pressure.

Key factors shaping the market:

- Supply issues: Indonesia is evaluating production cuts to prevent oversupply and support prices.

- Strategic acquisitions: Chinese companies continue expanding their influence by purchasing nickel assets globally.

- EV sector growth: Demand from battery manufacturers is rising consistently.

Overall, nickel’s balance between supply and EV-driven demand continues to influence price direction.

How FintechZoom.com Nickel Provides Market Insights

FintechZoom.com offers several features that make it useful for tracking nickel markets:

1. Real-Time Price Tracking

The platform provides updates sourced from major exchanges such as the LME (London Metal Exchange), helping users monitor price changes throughout the day.

2. Market Analysis & Commentary

FintechZoom publishes articles covering:

- Supply and demand shifts

- Global trade impacts

- Mining activity

- Industrial usage

- Market-moving news events

These insights help readers understand why nickel prices rise or fall.

3. Price Forecasts & Predictions

FintechZoom offers algorithm-based forecasts supported by expert commentary. These predictions help traders anticipate potential swings in the market.

4. Historical Price Data

Users can access multi-year charts to analyze long-term trends, volatility, and market cycles. This is particularly helpful for strategists and long-term investors.

5. Global Market Coverage

Coverage includes movements in Asian, U.S., and European markets, providing a full international view.

6. Trading Tools

FintechZoom offers sentiment indicators and basic trend analysis tools to support trading decisions.

7. News Aggregation

It collects relevant nickel industry updates, including mining announcements, geopolitical shifts, production forecasts, and corporate developments.

Is FintechZoom.com Nickel Reliable?

FintechZoom’s data is fairly reliable for general tracking, but it has limitations.

Strengths

- Pulls information from credible sources

- Offers fast updates

- Provides simple breakdowns for casual users

Limitations

- Does not fully disclose all data sources

- Some price information may lag compared to primary exchanges

- Not ideal for institutional-level trading decisions

For casual investors, the data is adequate.

For professional traders, cross-verification is necessary.

FintechZoom.com Nickel vs. Competitors

| Feature | FintechZoom.com | LME | Investing.com | TradingView |

| Data Reliability | Medium | Very High | Medium–High | High |

| Price Updates | Slight delay | Real-time | Fast | Real-time |

| Analysis Depth | Basic | Institutional | Retail-level | Advanced |

| Transparency | Low | Very High | Medium | High |

| Cost | Free | Paid | Free/Paid | Freemium |

Key Takeaways

- FintechZoom is excellent for quick checks and beginner-friendly market news.

- LME (London Metal Exchange) remains the most authoritative nickel pricing source.

- TradingView is best for technical analysis.

- Investing.com offers a good middle-ground for retail traders.

- FintechZoom’s strength lies in accessibility, not depth.

How to Use FintechZoom.com Nickel Effectively

- Visit the Nickel Page

Navigate to the commodities section to find live nickel prices.

- Check Real-Time Data

Prices are updated frequently, though slight delays are possible.

- Study Historical Trends

Use multi-year charts to analyze nickel cycles and volatility.

- Use Indicators

Tools like Moving Averages or RSI can help identify buying or selling opportunities.

- Set Alerts

Sign up for price alerts to act quickly when the market shifts.

- Stay Informed with News Updates

Read FintechZoom’s curated market news for geopolitical and economic developments.

- Check Expert Forecasts

Use predictions as a reference point—but always cross-check with other platforms.

Pros & Cons of FintechZoom.com Nickel

Pros

- Free access

- Regular price updates

- Easy-to-read format

- Good for beginners

- Wide coverage of news events

- Includes mining industry insights

Cons

- Data transparency is limited

- Price updates may lag compared to LME

- Lacks advanced charting tools

- No proprietary research

- Technical depth is limited

Future Outlook for FintechZoom.com Nickel

As the nickel market grows more complex, FintechZoom is expected to expand its tools and analysis features. Future enhancements may include:

- More real-time data sources

- In-depth supply chain reports

- Expert interviews

- Better charting tools

- More advanced forecasting models

With EV markets expanding globally, FintechZoom’s nickel coverage will likely become more detailed and more valuable for readers looking to understand the metal’s long-term trajectory.

Final Words

FintechZoom.com Nickel is a great starting point for anyone wanting to follow nickel market developments. With easy access to price updates, market analysis, and relevant news, the platform serves as a helpful resource for casual traders and curious investors.

However, for deep technical studies or precise trading decisions, users should complement FintechZoom data with more advanced platforms like the LME or TradingView. FintechZoom remains best suited for general market awareness, quick price checks, and everyday insights into the evolving nickel market.

FAQs

How do I check nickel prices on FintechZoom.com?

Visit the commodities section on FintechZoom and navigate to the nickel page for live price updates.

Is FintechZoom.com Nickel free to use?

Yes, basic price tracking and market insights are available for free.

What other commodities does FintechZoom cover?

You can track gold, silver, natural gas, oil, and various financial markets including stocks, crypto, and forex.

How often is nickel price data updated?

Updates occur frequently, but slight delays are possible depending on data sources.

Can I trade nickel on FintechZoom?

No, FintechZoom only provides information. You must use an external broker or exchange to trade.